Unlocking CMHC Financing: What Mortgage Brokers Won’t Tell You (Part 1)

/🏘️ Can MLI Select Really Help You Secure Millions in Financing? I’ve Used It on Two Projects—Here’s the Truth

Over the past two years, I’ve used CMHC’s MLI Select mortgage insurance program to secure funding for two multi-unit townhouse developments in Calgary.

Today, I want to share exactly what makes this program so powerful, who it’s for, and the important details that mortgage brokers may not tell you.

✅ Why CMHC Financing Deserves a Closer Look

In today’s environment of high interest rates and tight credit, CMHC’s loan insurance is one of the few tools left that offers:

High leverage

Long amortization terms

Lower interest rates

For real estate investors and developers, especially in competitive markets like Calgary or Banff, maximizing financing efficiency is crucial for sustaining long-term project pipelines. MLI Select was designed with that exact goal in mind.

🧱 What Is CMHC?

CMHC (Canada Mortgage and Housing Corporation) is a government-backed institution that insures mortgage loans for rental and affordable housing development in Canada.

Their goal? Encourage the creation of long-term, affordable housing through financial programs like MLI Select.

🧮 What Is MLI Select?

MLI Select is a flexible, points-based insurance program available for new or existing rental apartment projects with 5 or more units.

You earn points by meeting one or more of these criteria:

✅ Offering affordable rents (below-market rates)

✅ Using energy-efficient or low-carbon construction

✅ Improving accessibility for seniors and individuals with disabilities

If your project scores high enough, you can access:

Up to 95% loan-to-value (LTV)

Insurance premiums as low as 2.8%

Amortization up to 50 years

Interest rates typically 2% lower than conventional commercial loans

🏗️ What Project Types Qualify?

You can apply for MLI Select if you’re:

Purchasing an existing rental apartment

Refinancing a stabilized rental property

Building a new multi-unit rental project

✅ Important: Properties must have 5 or more long-term rental units—short-term rentals and owner-occupied homes don’t qualify.

📊 How MLI Select Compares to Conventional Loans

Here’s a comparison:

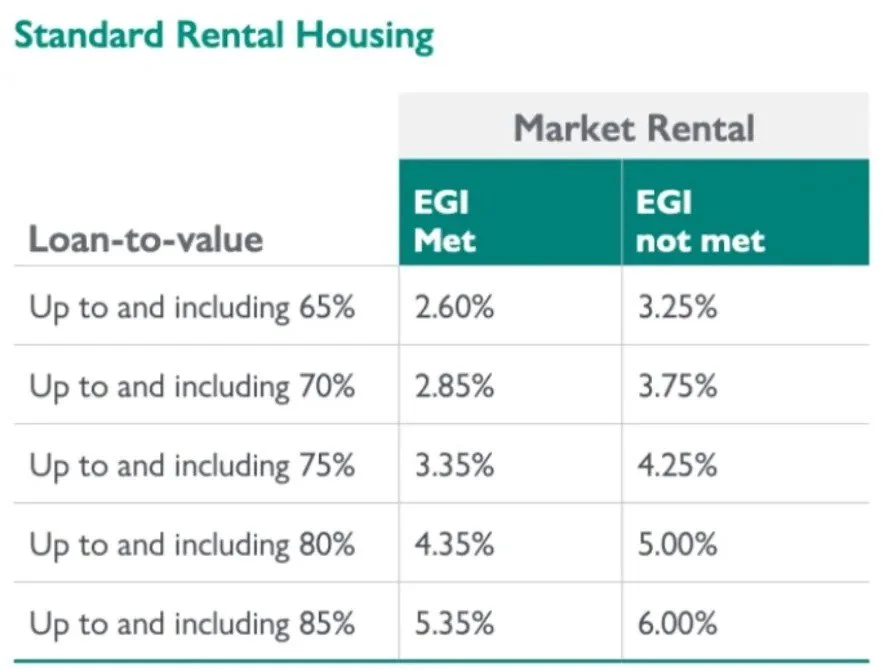

CriteriaConventional LoanMLI Select (Qualified)Loan-to-ValueUp to 85%Up to 95%Insurance Premium~6%As low as 2.8%Amortization25 yearsUp to 50 years

The takeaway? MLI Select can greatly reduce monthly debt service and capital requirements—ideal for developers managing multiple projects.

Comparison of standard commercial loan premiums vs CMHC-backed insurance.

Official screenshot showing 2.8% CMHC insurance rate under MLI Select program.

🏘️ Real Projects We Completed with MLI Select

Completed 4+4 unit townhome project by Raynow Homes, eligible under CMHC MLI Select.

Exterior view of Raynow Homes’ 4+5 unit CMHC-financed townhouse development in Calgary.

In 2022 and 2024, we used MLI Select to finance two multi-unit townhouse projects in Calgary.

One secured 90% LTV with a 40-year amortization

The other received lower premiums through a higher environmental and affordability score

From application to final lender rate lock, the full process took about 6 months, but the results were well worth the wait.

⚠️ It’s Not “Free Money” — The Rules Matter

📷 [Insert chart previewing scoring criteria – Part 2 teaser]

MLI Select isn’t automatic approval. You must hit the scoring benchmarks, and several hidden details can affect your eligibility:

What qualifies as “affordable rent”?

How is energy performance verified?

How does your construction timeline affect approval?

What project types qualify for longer amortization?

👀 I’ll break all of this down in Part 2—including real tips from our own application experience.

🛎️ Follow us or bookmark this post to stay updated!

🔎 Want to build in Calgary or Banff?

Whether you’re developing a 5+ unit townhouse or a rental apartment building, MLI Select can reduce financial pressure and improve long-term returns.

Have questions about eligibility or how to start? Contact us at Raynow Homes, or stay tuned for our next post covering how to actually score your project.